Who Should Register for VAT/Sales Tax in Pakistan

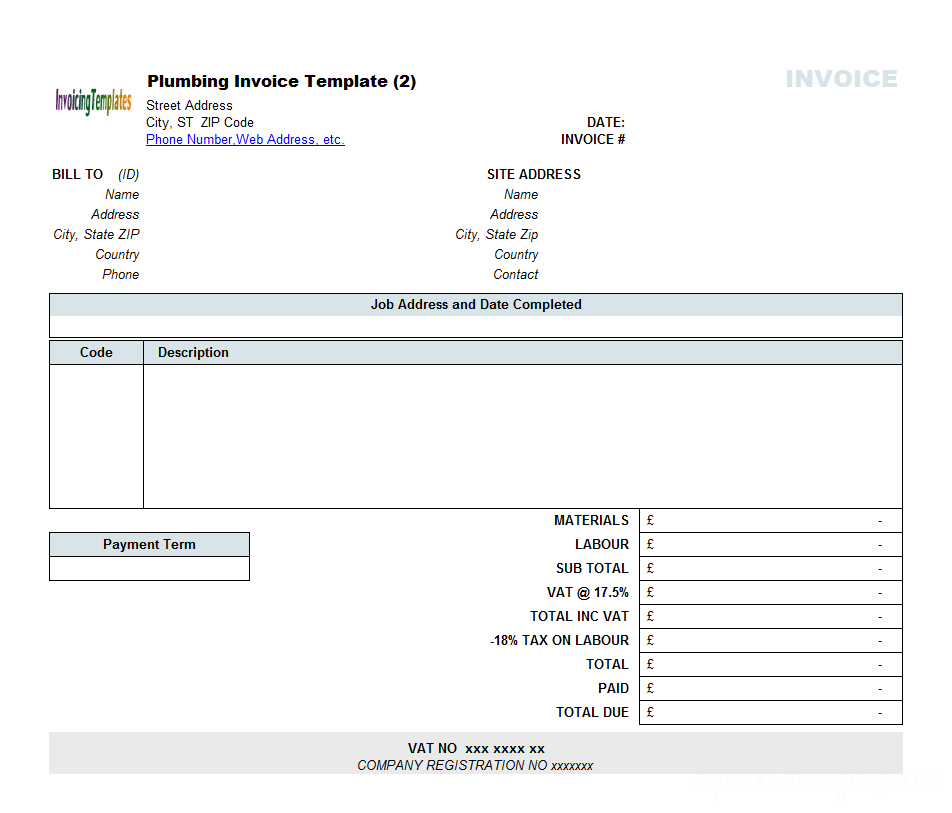

Download UAE VAT Invoice Format for Rent A Car Business In Excel-Ready-To-Use UAE VAT Invoice Format for Rent a Car Business. It is a ready-to-use invoice template with predefined formulas and VAT computations for the Car Rental business. We have created the UK VAT Dual Currency Invoice excel template with predefined formulas that will help you to issue the invoice with 2 currencies. One is Sterling Pound and another currency whichever is applicable. A dual currency invoice is prepared when the goods or services supplied are from a foreign location or in foreign currency. Yes, even if you don’t have a registered account, our invoice generator offers a customizable ready-made invoice template to create & instantly download the PDF copy of your Pakistan invoice or save the information to use later. How do I send a Pakistan VAT/No VAT invoice? Send the created PDF Pakistan invoice electronically or print it. UK VAT Invoice With Discount is a ready-to-use excel template that helps you to issue a VAT compliance invoice with a discount for taxable goods and services with auto calculations. Usually, retailers offer discounts to their customers. Moreover, semi-retailers also give discounts to.

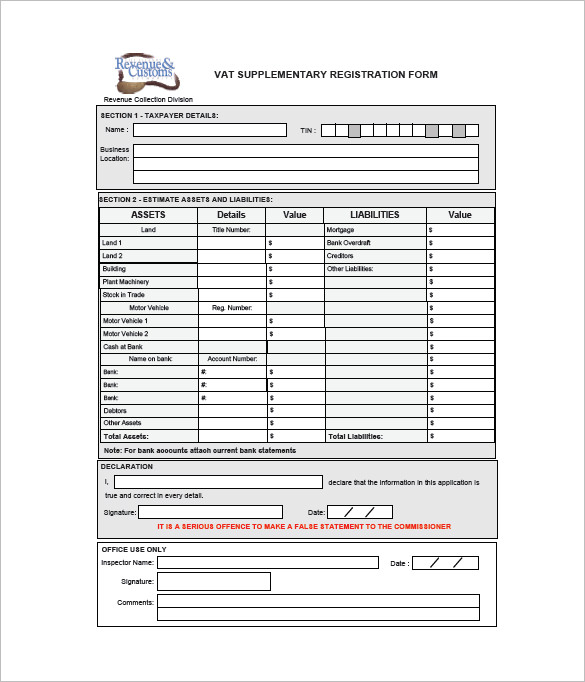

All businesses and suppliers of taxable goods must register for Pakistani sales tax via FBR’s online portal. Generally, tax registration will also require an in-person meeting. In order to process the application, you will be asked to provide the following:

● Business name

● Business address

● Business bank accounts

● Tax identification business directors

● Passports of business directors

Any Pakistani business that fails to register for sales tax may be fined. Since there is no threshold for businesses required to register for sales tax, most businesses will have to register with BIR. Although the registration threshold is nil, businesses with low business turnover may be eligible for a simplified sales tax scheme. Sales tax is due in Pakistan at the time of supply or at the time of payment.

Vat Invoice Meaning

Businesses registering with FBR for sales tax will receive a Sales Tax Registration Number (STRN) or User ID and password that will be used in all electronic filing for sales tax returns. Unlike many countries, non-resident businesses operating in Pakistan may not register for sales tax, regardless of turnover.